35+ Home equity loan payment calculator

Personal loans typically range from 2000 to 50000 though some providers offer loans as low as 1000 and as high as 100000. However note that equity extraction impacts your interest rate.

Best Home Loans Mortgage Lenders Company Arizona Utah

Loan Payment Calculator.

. Customers are eligible to receive a 2000 cashback payment if the loan amount is 250000 up to. Investing in a home is a good strategy for a parent who needs to be paid back and possibly make some money on the house in the long run. You can use the following calculators to compare 15 year mortgages side-by-side against 10-year 20-year and 30-year options.

The asset home is evaluated to affirm that it is. Check our personal loan prepayment calculator and find out the prepayment amount required for personal loan. Enter your loan amount.

You may be able to deduct the interest paid on a home equity loan or HELOC if the funds were. Another way to save money on your mortgage in addition to adding extra to your normal monthly payments is the bi-weekly. Simply enter the amount you wish to borrow the length of your intended loan vehicle.

Enter your loan term. 85 LVR youll pay a premium of 035 pa. Loan payment calculator.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Full usage instructions are in the tips tab below. The more equity you have on your home the higher the amount you can borrow.

LTV is based on the total debt to equity ratio for a property so if one borrows 80 of a homes value on one loan 10 of a homes value on a second mortgage then the total LTV is 90. Take the 10 number divide it by 2 The above rules of thumb will skew slightly low because they do not include closing. Lenders typically extend their best rates terms to borrowers who put down a.

Home buyer looking to expand your existing home or just thinking to live rent-free for all your life Tata Capitals Home Loan is the ideal solution to all your home loan. The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan. You will only need to pay for mortgage insurance if you make a down payment of less than 20 of the homes value.

For example a 30. The amount of loan taken should be Rs 35 lakh or less and the propertys value does not exceed Rs 50 lakh. You get a lump sum upfront.

Follow these steps to calculate the monthly payment and total cost of a personal loan. Most payment options include a deposit amount if the purchase if not made at once. If you need more help talk to one of our home loan experts.

WEDDING LOAN FUNDING UP TO RS. Examples of variable loans include adjustable-rate mortgages home equity lines of credit HELOC and some personal and student loans. Loan types offered.

Mortgage insurance typically costs 05 185 percent of your loan amount per year billed monthly though it can go higher or lower depending on your credit score down payment and length of your loan. Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost. Calculate Home Loan Eligibility.

How to use this personal loan calculator. If you want to apply for a home equity loan lenders will typically require equity in your home a healthy credit score and history and verification for your income. Get the peace of mind by knowing all the details about your loan using HDFC Home Loan Eligibility Calculator.

So if at all possible save up your 20 down payment to eliminate this drain on your finances. 10000 to 200000 HELOC. Compare BNZ home loan rates and fees.

Home equity loans are limited to 100000 or the amount of equity you have in your home. This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. Personal loan rates currently range from 5.

And on the date of loan sanction the individual does not own any other house ie. Discover Home Loans offers loans from 35000-300000. This means your LTV ratio is 45 while your home equity is 55.

When lenders consider you for a home equity loan or HELOC these criteria will count the most. Remove the far right number from the homes price 20 down. For example if you bought a home for 200000 and your mortgage balance is 90000 your home equity is worth 110000.

Payment History 35 Amount Owed 30 Length of Credit History 15. One of the most popular arrangements is a Shared Equity Financing Agreement SEFA. The loan must have been sanctioned between 1st April 2016 to 31st March 2017.

Starting at 329 HELOC. 500000 to less than 1000000. For more information about or to do calculations involving any of these other loans please visit the Mortgage Calculator Auto Loan Calculator Student Loan Calculator or Personal Loan Calculator.

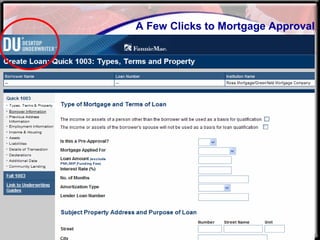

Credit score ratings. Mortgage loan basics Basic concepts and legal regulation. Los-doc loans rely on self-certification which is the personal approval that a borrower can offset the loan amount.

A low equity interest rate premium will apply to all loans with less than 20 equity more than 80 Loan to. For example say your home is worth 350000 your mortgage balance is 200000 and your lender will allow you to borrow up to 85 of your homes value. Between 9001 95 youll pay 1.

Enter the amount you want to borrow. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Home equity loan HELOC.

Number of payments over the loans lifetime Multiply the number of years in your loan term by 12 the number of months in a year to get the number of payments for your loan. Take the 10 number double it 5 down. AMP Professional package offers an introductory variable or fixed rate to tailor your home loan giving you the flexibility to structure your debt.

It is also a good strategy if the parent wants to invest an amount that exceeds the annual gift tax. Censusgov all others NAR Quickly Estimating Down-payments. It does nothing for you except put a hole in your pocket.

Visit DHLs loan amount calculator. Between 8501 90 youll pay 075 pa. 3599 APR and terms from 24 to 60 months.

Investing in a home. Our calculator limits your interest deduction to the interest payment that would be paid on a 1000000 mortgage. Once the equity reaches 20 of the loan the lender does not require PMI.

Any interest paid on first or second mortgages over this amount is not tax deductible. Rules of thumb for quickly estimating down-payment amounts. 35 of prospective home owners are intimidated by the deposit amounts for a property.

Home Loan eligibility is dependent on factors such as your monthly income current age credit score fixed monthly financial obligations credit history retirement age etc.

Blockfi Review 2022 Pros Cons And Features Marketplace Fairness

Home Equity Oak Tree Business

Top 70 Fintech Startups In India Startuplanes Com

Average Down Payment For A House Here S What S Normal

Home Loan Tips How To Get A Home Loan Home Loans Home Renovation Loan Home Improvement Loans

2

A Main Street Perspective On The Wall Street Mortgage Crisis

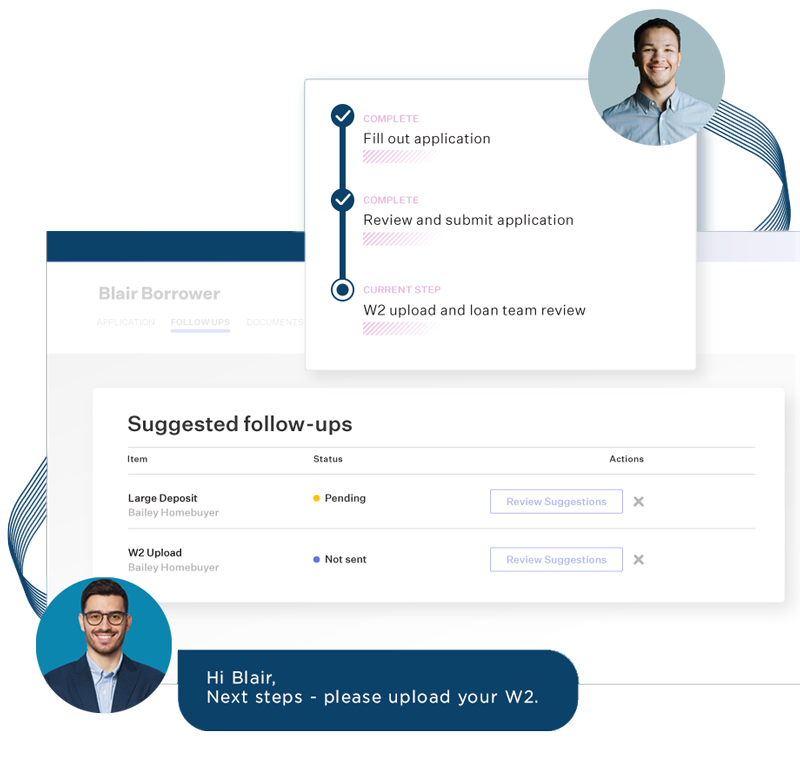

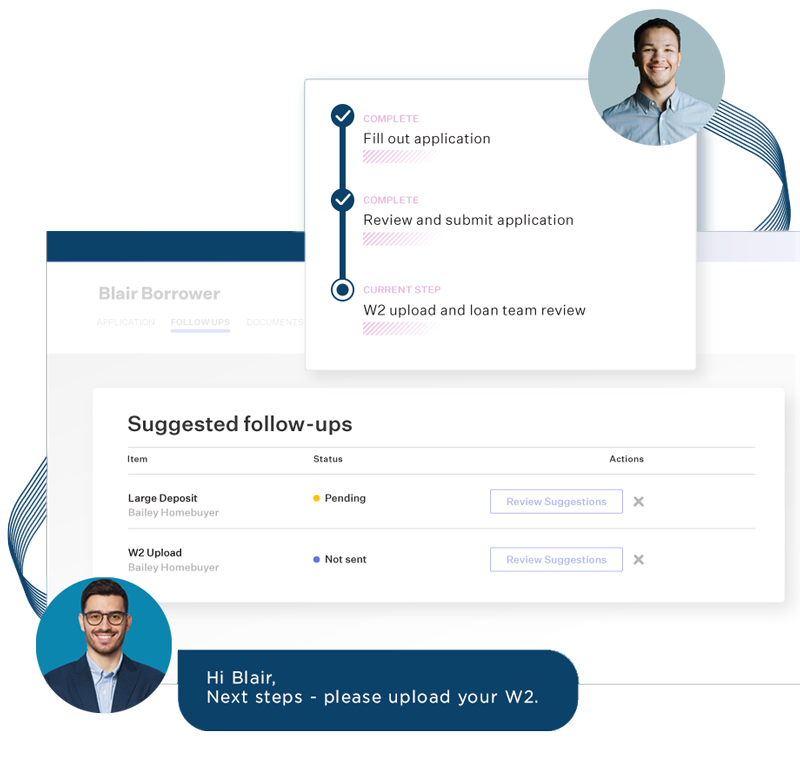

Best Home Loans Mortgage Lenders Company Arizona Utah

Kuvera Review Direct Mutual Funds Corpus Can Be Up To 50 Higher Over 30 Years Bachatkhata Com

45 Best Startup Budget Templates Free Business Legal Templates

Average Down Payment For A House Here S What S Normal

Best Home Loans Mortgage Lenders Company Arizona Utah

Home Equity Oak Tree Business

Veritex Holdings Nasdaq Vbtx Veritex Holdings Inc General Corporate Statement Form8 Benzinga

Best Reverse Mortgage Services In Arizona Sun American

Average Down Payment For A House Here S What S Normal

45 Best Startup Budget Templates Free Business Legal Templates